Abdur Rahim (67) lazily passes his days at his shabby little home in Duwaripara slum. Being a retired day-laborer, he is now financially dependent on his wife’s and daughter’s income, both of whom work as part-time maids for several families in Pallabi, Dhaka. Rahim, sitting at a teastall with a bunch of his contemporaries, expresses

- Published in Blog, News and Media

No Comments

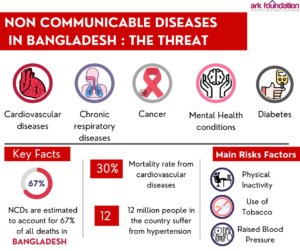

By Tahmid Hasan In Bangladesh, NCDs are estimated to account for 67% of all deaths. In low and middle-income countries, urbanization has been identified as one of the crucial underlying reasons for the increasing trends of NCDs. Bangladesh has also been experiencing rapid urbanization for the past two decades. The urban population of Bangladesh has increased

- Published in Blog, News and Media

By Rumana Huque The World Health Organisation (WHO) strongly promotes the primary care principles enshrined in the 1978 Alma Ata declaration which emphasises equity, inter-sectoral collaboration, access to essential drugs, appropriate health technology, and comprehensive care. A Primary Health Care (PHC) approach from a services delivery perspective can be characterised as primary care: the continuum

- Published in Blog, News and Media

- 1

- 2